As a sole proprietor on the other hand youre responsible for 100 of these taxes. Only the owner is allowed to apply.

House Rental Agreement Format Docxfind This Example Of Simple House Rent Agreement To Rental Agreement Templates Buying A Rental Property Room Rental Agreement

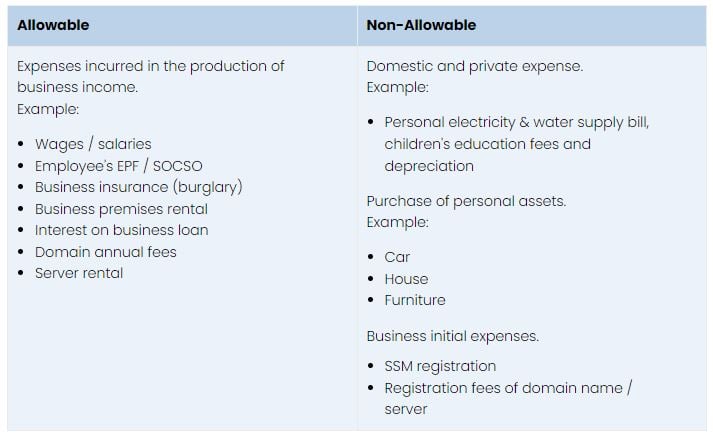

Even though businesses have been registered with SSM business owners are responsible for.

. You must select the following options on this page. Continue by pressing the enter key. All profit loss generated by the business will go directly to the owner.

The businesss name and address. A bank account opened in the businesss name. The overall simplicity of execution.

20 lakhs it must register under the GST. Registration under the Shop and Establishment Act of the relevant state. A sole proprietor is a business owned by only one individual.

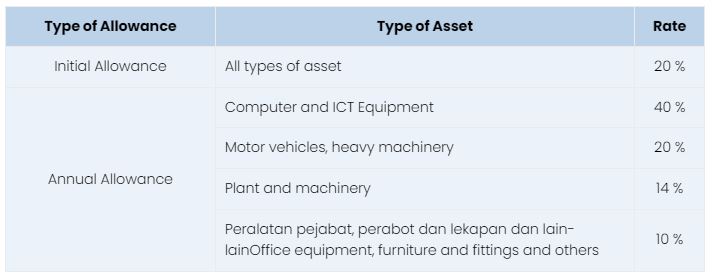

The first RM70000 of your chargeable income category F RM4400. Should the owner ever decide to expand there is always the opportunity to change the business to either a partnership or a private. The upfront tax estimate will be payable bi-monthly in 6 instalments.

Normally youd have to pay yourself the part that your boss paid for you. A photocopy of IC front and back of you and partners if applicable RM 60 If your sole prop is using a. The main difference between a sole proprietor and a private limited Sdn Bhd company is the number of officeholders.

9 rows Sole Proprietorships. Additionally setting up a sole proprietorship still allows an opportunity for the business to grow. Safest way to ascertain that the payroll software you want to use is safely compliant with employment requirements in Malaysia for tax filing purposes like Borang E.

The self-employment tax rate for 2022 is 153 which means you will have to put aside half of your net earnings in order to make that payment. Guide To Using LHDN e-Filing To File Your Income Tax. A sole proprietor is someone who owns an unincorporated business by himself or herself.

These taxes are referred to as self-employment taxes and. To register a sole proprietorship in Malaysia the following criteria must be fulfilled. Income tax filing for sole proprietors is a fairly straightforward process.

Total tax payable RM6500 before minus tax rebate if any Lets do another example. The lower cost for setting up the company. Only available for Malaysian Citizens and PR holders only.

The next RM10000 of your chargeable income 21 of RM10000 RM2100. All partnerships and sole proprietorships must now file this form as well. However if you are the sole member of a domestic limited liability company LLC you are not a sole proprietor if you elect to treat the LLC as a corporation.

However as a sole proprietor you may deduct half of that self-employment tax yourself. It is basically the simplest for of business ownership available in Malaysia and most local businessmen tend to opt for this structure. In Malaysia the tax authority collect taxes from sole proprietorship and partnerships upfront.

If you are a sole proprietor use the information in the chart below to help. The lower amount of paperwork. Year of assessment ITR form Type of filing originalrevised In the submission mode choose prepare and submit.

Income tax for sole proprietorship. Hence no separate tax return filing is required. Then go to the e-filing menu and choose Income Tax Return.

The owner must be aged 18 years and above. Conversely to register for a private limited Sdn Bhd company you will need to have at least one. For Sole Proprietorship a checklist is necessary.

If the companys annual revenue reaches Rs. You will receive a letter from the tax authority the CP500 informing you of the amount of taxes which you need to pay. The sole proprietorship in Malaysia is governed by the Registration of Businesses Act 1956.

The owner must be a Malaysian citizen or permanent resident of Malaysia. Any dormant or non-performing company must also file LHDN E-Filing. A PAN card for the proprietor.

Instead of filing Form BE which is filed by individuals under employment or having non-business income sole proprietors file Form B before 30 June on an annual basis. There are no other officeholders in a sole proprietorship. Say your chargeable income for Year Assessment 2021 is RM65000.

Economy Of Malaysia Economic Outlook History Current Affairs Malaysia Economy Outlook

Company Formation In Switzerland Corporate Bank Public Limited Company Switzerland

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Type Of Business Entities Limited Liability Partnership Private Limited Company Public Limited Company

Faq Company Registration In Bangladesh Business Starting A Business Services Business

Accounting Malaysia Importance Of Financial Statement By Beyondcorp Financial Statement Accounting Financial

Legal Archives Templatelab Reference Letter Support Letter Letter Of Recommendation

Faq Company Registration In Bangladesh Business Starting A Business Services Business

Malaysia Personal Income Tax Guide 2021 Ya 2020

25 Ideas For How To Start A Small Business At Home In 2022

Third Party Accounting Services In Singapore Makes You Completely Tension Free Accounting Services Accounting Bookkeeping Services

Malaysia Personal Income Tax Guide 2021 Ya 2020

Top Ten Mistakes To Avoid When E Filing Form 2290 Online For Ty 2020 21 Irs Forms Irs Employer Identification Number

Sugar Import In Malaysia Process Of Applying For This License Malaysia Sugar Tax How To Apply

How To File Income Tax For Your Side Business

How To File Income Tax For Your Side Business

/underwriter-FINAL-e117e9db93784cbcb6f98ac33e8d917d.png)